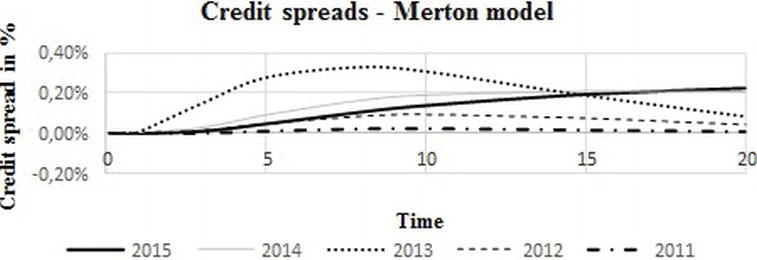

Modeling Bond Spreads and Credit Default Risk in the Norwegian Financial Market Using Structural Credit Default Models | Beta

options - Relationship between risk free rate and credit spread in the Merton model - Quantitative Finance Stack Exchange

PDF) Merton models or credit scoring: modelling default of a small business | Jake Ansell - Academia.edu

options - Relationship between risk free rate and credit spread in the Merton model - Quantitative Finance Stack Exchange

options - Relationship between risk free rate and credit spread in the Merton model - Quantitative Finance Stack Exchange

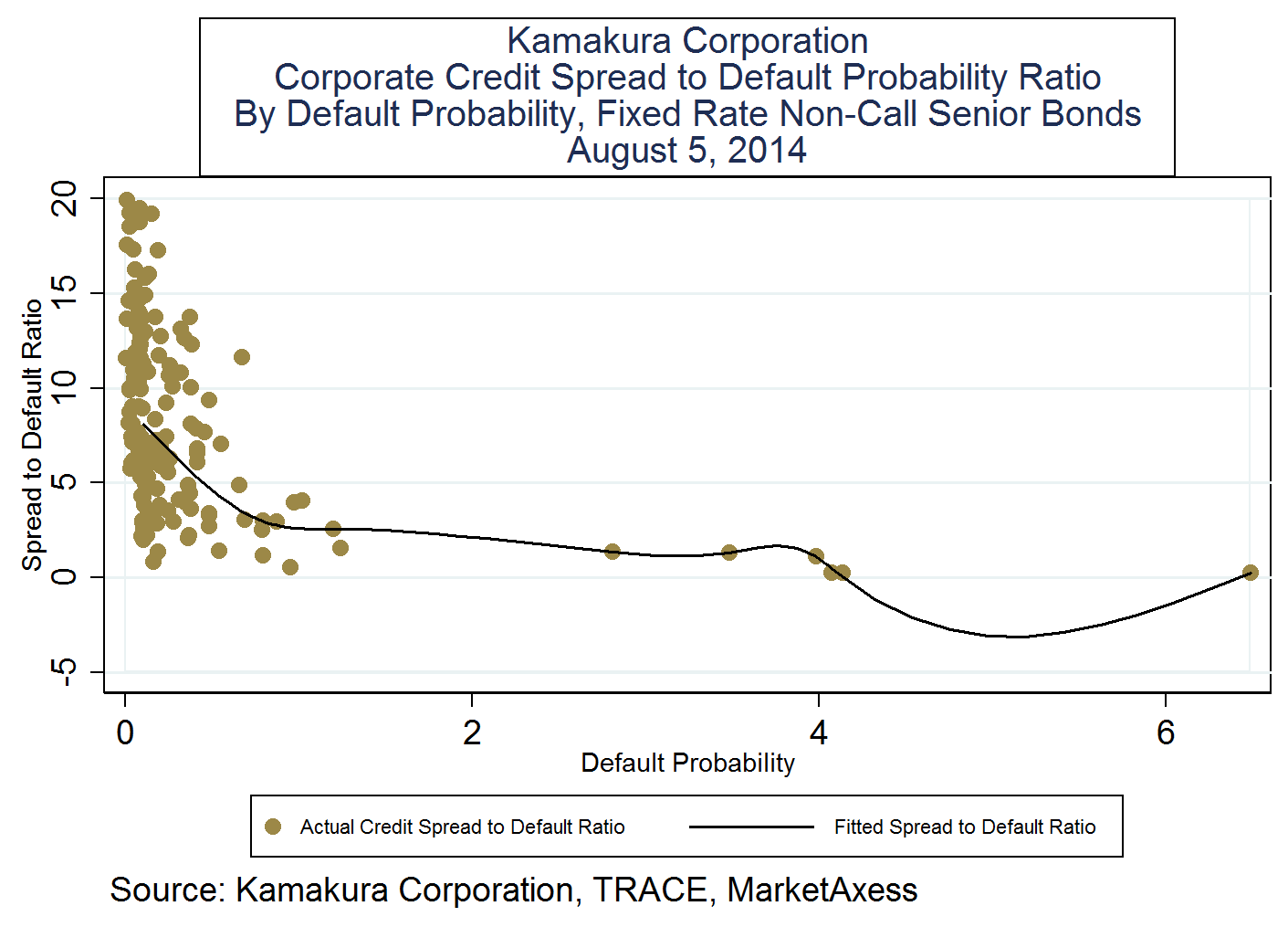

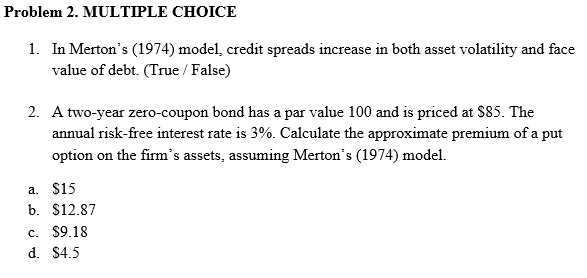

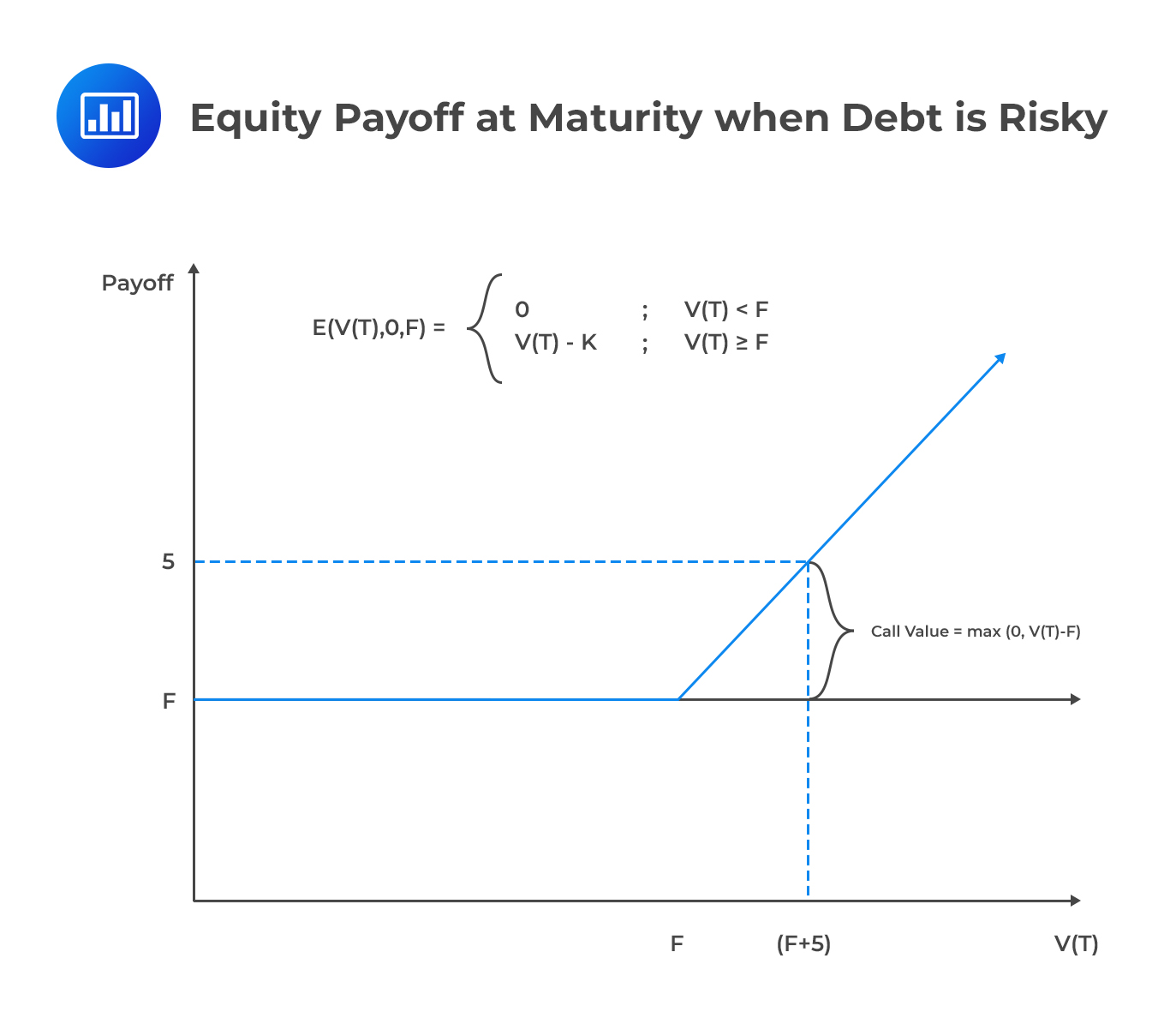

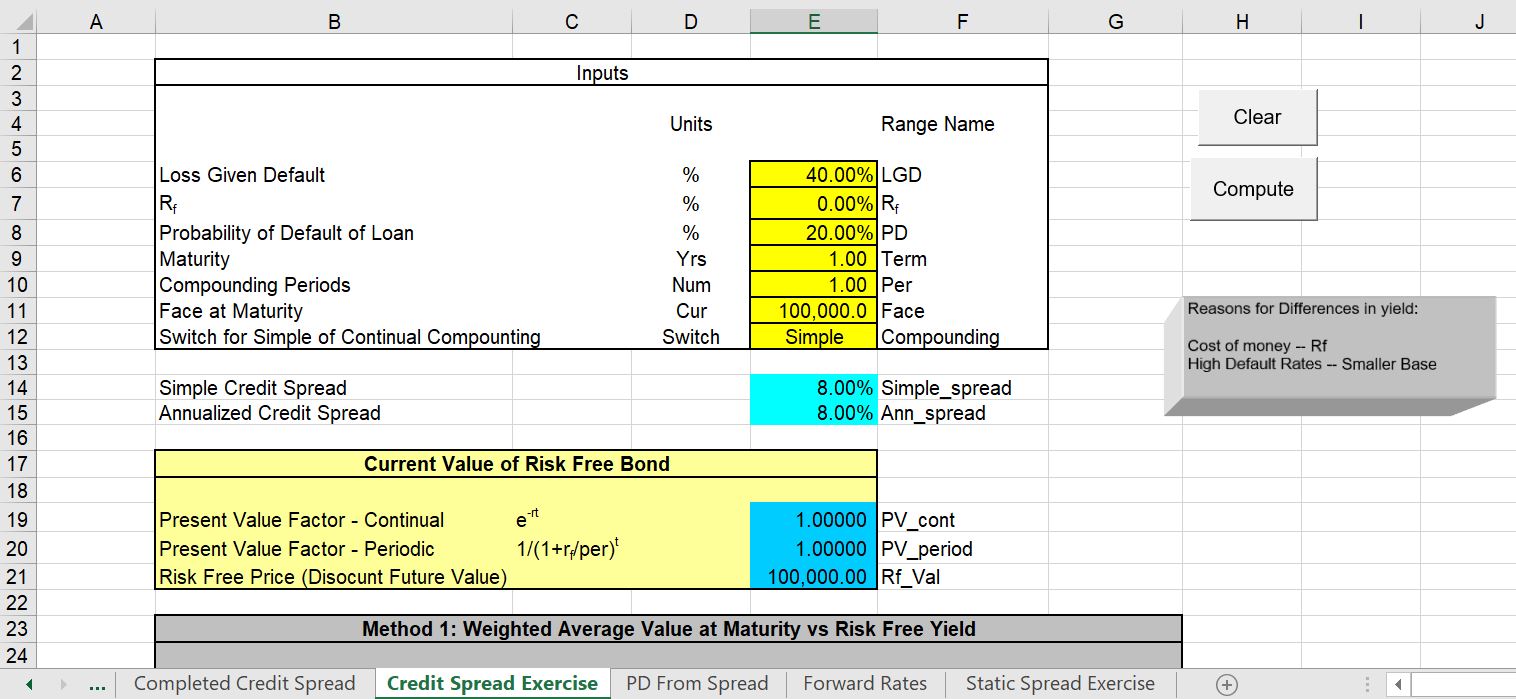

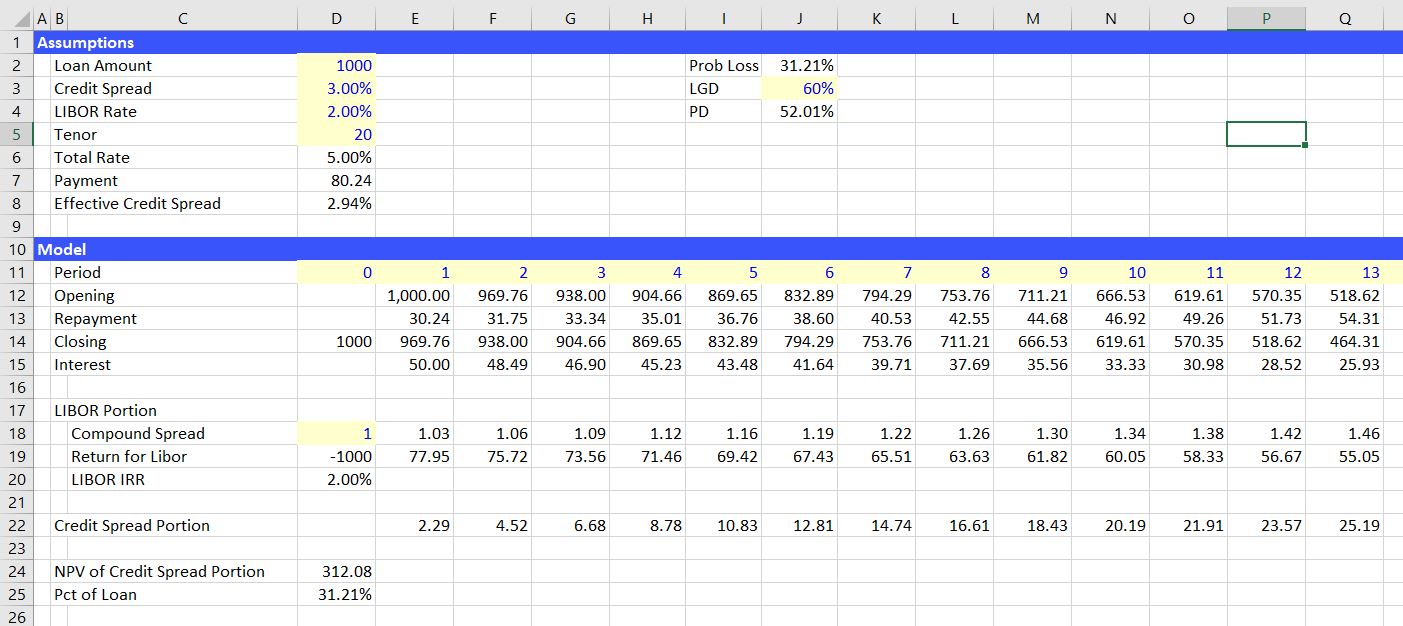

Merton Model and Credit Analysis in Project vs Corporate Finance – Edward Bodmer – Project and Corporate Finance

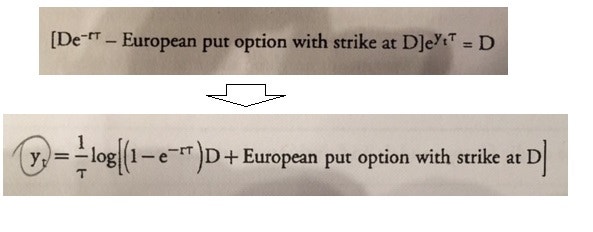

GARP.FRM.PQ.P2 - question in derivation process of merton model credit spread | Forum | Bionic Turtle

Merton Model and Credit Analysis in Project vs Corporate Finance – Edward Bodmer – Project and Corporate Finance

Introduction to Credit Derivatives Uwe Fabich. Credit Derivatives 2 Outline Market Overview Mechanics of Credit Default Swap Standard Credit Models. - ppt download

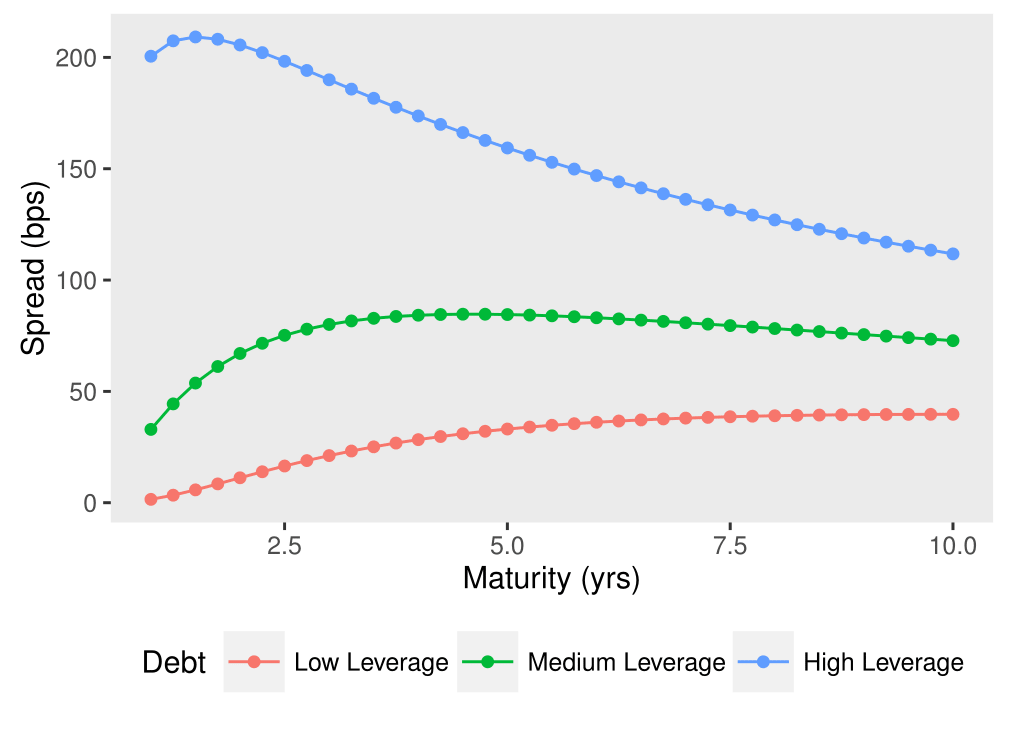

![PDF] Merton's and KMV Models in Credit Risk Management | Semantic Scholar PDF] Merton's and KMV Models in Credit Risk Management | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/2f499664eea3d5084b8fc3a8dd5fe60beaa6a3fd/8-Figure6-1.png)